Applying Intra-Family unit members Mortgage loans

One of the greatest challenges for most family provided intra-family members financing – eg intra-family unit members mortgages – is just the administrative really works and requirements doing the mortgage properly, particularly just like the mortgage need to be properly registered against the quarters towards focus is allowable on debtor (and you may significantly, clear documentation of the loan is also required if the bank ever before wants an income tax deduction having amounts maybe not paid on experience the latest debtor defaults).

As well, specific group in fact favor a more specialized mortgage plan; such as, if moms and dads-as-loan providers it’s create wish the transaction since a loan (and not a masked gift), they wish to make certain the little one-as-borrower respects they correctly and finds out particular financial duty (albeit when you find yourself nonetheless watching a great deal more positive loan terms than simply will be obtained from a bank, and you can remaining the borrowed funds interest in your family). Rather, in the event your money is getting loaned out of a family group trust, the brand new trustee might wish for the borrowed funds are securely recorded and you will filed so you can establish one fiduciary obligations to manage the fresh believe corpus responsibly are being met.

An appealing the newest solution within this place is Federal Members of the family Mortgage, a family you to functions as this new “middle child” to assist techniques and keep intra-nearest and dearest mortgage loans, dealing with from creating within the promissory note within activities, recording the fresh deed regarding trust you to definitely pledges the house or property once the security and you will tape it regarding proper legislation, creating digital fund import preparations getting loan repayments (together with escrow for home insurance and property taxation, in the event that wanted) and sending out fee notices and balance comments, and also providing the proper Internal revenue service reporting variations (the form 1098 towards borrower to own financial interest reduced, additionally the Means 1099-INT for the financial for focus gotten). If for example the financing was organized since focus-just, the newest Federal Family Financial solution may also be helpful plan for an effective portion of the mortgage to get forgiven a year (that is less planning lead to Internal revenue service analysis when interest will be paid off, loan documents are submitted, and all of the other conformity of transaction are now being respected).

The price towards the services is a-one-big date fee between $725 and $2,100 (depending on the size of the loan) towards the loan data files (and therefore, rather, could be however much less compared to origination payment having a great antique mortgage!), an extra tape tax paid back straight to the official/state (to possess jurisdictions that require they), and ongoing financing servicing (into comments, digital money import, Internal revenue service reporting, an such like.) will set you back $15/times (or some a lot more for huge funds, sufficient reason for an additional $15/day costs to possess escrow functions). Website subscribers of web log normally located an effective fifteen% write off toward you to-day fee your of its website subscribers whom make use of the solution because of the entering the promotion code “KitcesBlogDeal” (with no quotes) if visitors signs up. (Editor’s Mention: This is simply a complimentary provide in order to customers regarding the site; there is absolutely no monetary remuneration or other relationship between Nerd’s Attention Look at and you can Federal Family members Home loan.)

As a result, intra-friends mortgage loans might still be very appealing while the borrowing rates, even when the costs have to feel “sufficient” to satisfy brand new IRS’ AFR criteria

Sooner or later, intra-loved ones mortgage loans will still be a pretty “niche” method, whilst requires certain significant monetary wherewithal on the members of the family to spend the money for https://clickcashadvance.com/loans/business-loans/ loan so you’re able to children or other nearest and dearest on beginning. Nevertheless, functions particularly National Family members Home loan make procedure significantly better to apply and you can provide, as well as a fees that is however a lot less as compared to origination commission getting a vintage mortgage, whenever you are in addition continue all of the ongoing interest costs about family members. At today’s Relevant Government Prices, there are lots of chance of parents to aid children otherwise other family members create home sales more affordable, whilst producing what’s still a reasonable come back offered today’s reduced return environment!

Another advantage of intra-loved ones loans, particularly as the home financing for purchasing a home, would be the fact a few of the limits out-of traditional mortgage underwriting is actually no further problems; as an instance, loved ones won’t need to fees so much more to possess a kid having a bad credit get, and will easily bring money as much as 100% of purchase price as opposed to requiring a deposit. The loan was to own a first get, or a refinance, or a remodelling, that will getting organized just like the a second otherwise 3rd lien from the domestic. You to definitely well-known technique is for kids in order to use as much as 80% having fun with a timeless home loan to own a different sort of domestic buy, however, borrow cash out-of parents to fund the fresh down payment on the remaining 20% (registered once the one minute lien to the residence).

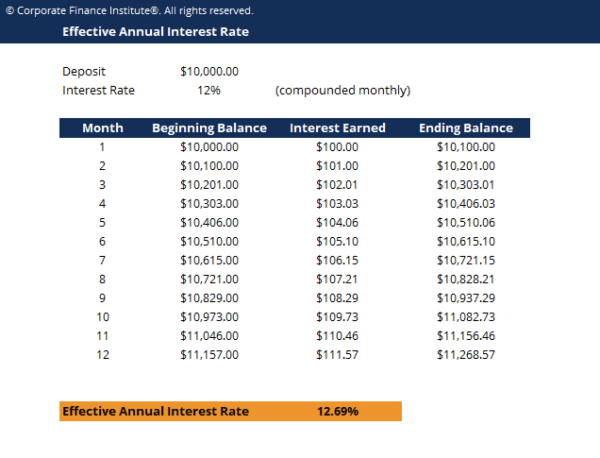

What exactly is distinguished, though, is that just like the Relevant Federal Rates are considered “ily mortgage attract at this costs hinders provide procedures, he or she is however amazingly advantageous rates; in recent months, brand new quick-term speed has been only one/last of 1%, brand new middle-label price simply lower than 1%, and even the latest long-title price are less than dos.5%! 8% (by the time associated with the writing), and a 30-season home loan is practically 3.5%.