Ways to get a western Share team mortgage

American Express financing downsides

Even as we mentioned at first, Western Show has many downsides you to ensure that it stays away from becoming one to your favourite lenders.

Uniqueness

The largest problem with Western Express’s business loans? These are typically readily available merely to American Share users?or, significantly more particularly, small-business owners you to definitely curently have a corporate charge card out of Western Share.

In fact, you should have got a western Display business credit to have a minumum of one season before you can probably be eligible for a keen Western Display organization mortgage.

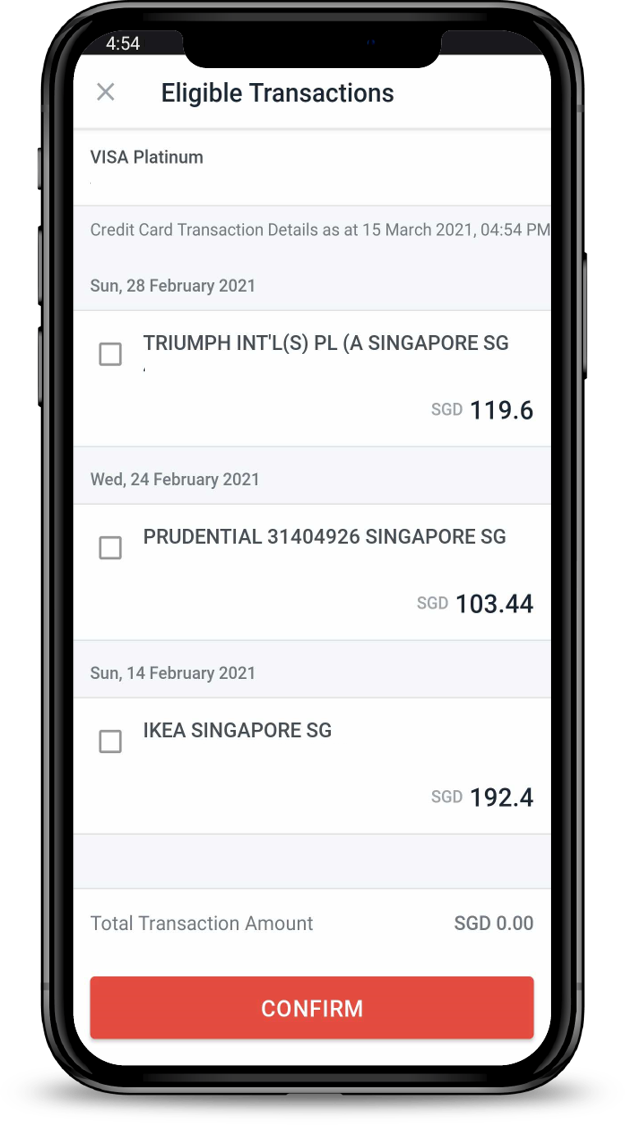

If you have got your credit card for example year, upcoming American Show can get pre-approve your to possess a business financing. You just need to look at the Western Display account and see when you yourself have an offer.

Today, we will speak more and more the loan pre-acceptance and you can software processes within the sometime. However, basic, how much does they try get pre-approved for a western Display organization financing?

Debtor criteria

Unfortuitously, American Display cannot number borrower criteria (outside the bank card demands). But obviously, if you want to rating a business loan away from Western Display, you need to be in a position to qualify for one of its charge card selection.

Lowest debtor conditions to possess Western Show

Data effective . From the publishing go out, financing versions and needs are most recent but are at the mercy of transform. Has the benefit of is almost certainly not obtainable in every area.

American Show does not record specific standards for the handmade cards both. But their credit card seeking device takes on that the organization can make at the least $one hundred,000 in yearly revenue. (altro…)