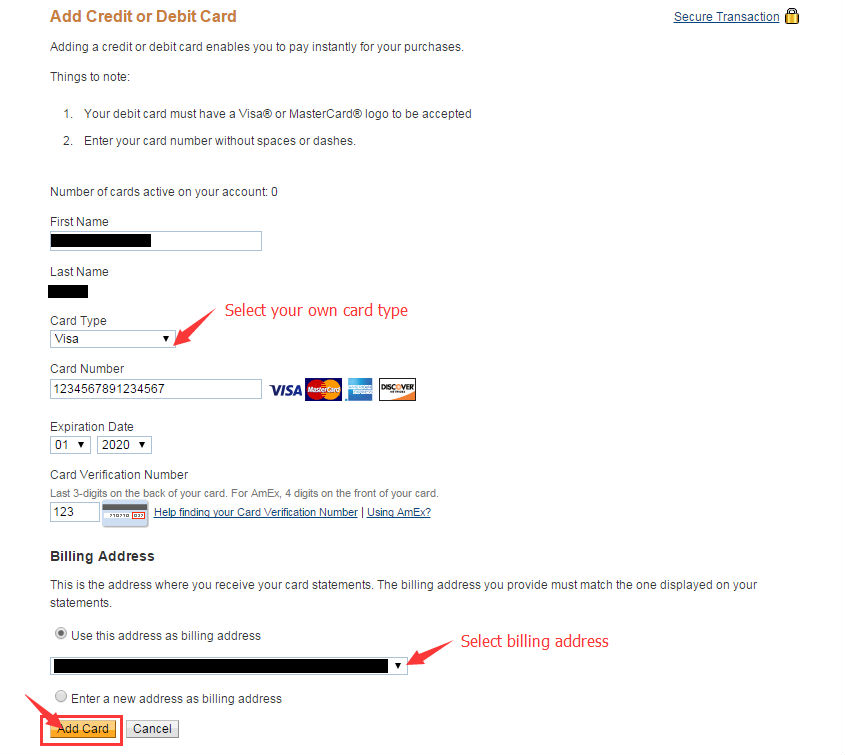

When you are finding a home loan you need to be searching for lump sum payment currency

- Knowing the fresh nationality & period of the fresh new candidate. Years is essential as home loan is long-term financing & the individual can be during the age cost until the loan is over.

- Monetary data clearly county all the ideas which you have. Like, in case the most recent loan’s EMI wasn’t repaid promptly it could well be traceable away from lender report.

- Credit history is very easily proven in the a number of files one youre designed to fill in to possess loan import. If the credit history isn’t as for every the necessity out-of lender away from NBFC might deny the application

- Month-to-month income would be calculated effortlessly in the a position & company data. It’s important to to have lender / monetary institute making sure that youre eligible for the fresh financing & you’ll able to pay off t punctually.

What makes the money evidence expected?

Financial or property financing ‘s the safest style of financing you to definitely is an assistance right here. Into the real estate loan you ought to mortgage one of the property say homes to the financial. You have made a lump sum payment amount of cash from the investment you are mortgaging. Now practical question is why should you need a living proof in order to get like loan?

Mortgage loans are really easy to avail but it is hard to access in case there are dispute. According to assistance regarding home loan if for example the debtor goes wrong to repay the loan count then lender can simply quit the latest investment which is are mortgaged. The lending company place the investment at discount and you can realize the money. But in matter of investment, when we think it over due to the fact homes, it is not easy to sell it well rapidly and you will understand the cash. Hence the lending company inspections on the borrowers’ money evidence so they really can be sure of the EMIs. (altro…)

/images/2022/11/17/balance-transfer-chart-2.jpg)