The new pre-certification procedure usually only requires a short while. From the putting away some time and energy to consider the choices, you will be top happy to pick the best personal bank loan to own your situation.

The initial step of getting pre-qualified for a personal bank loan should be to seek out personal loan enterprises. After you have recognized an established lender, apply online and deliver the financial with a few first personal data and you can information about your revenue and you will borrowing. The lending company use this short article to evaluate if you see their basic mortgage standards.

- Complete judge identity

- House and you will emailing target

- Big date away from delivery

- Social Safeguards number

- Manager title and commence go out

- Estimated credit score

- Terrible monthly money

- Factual statements about your current a fantastic loans

- Desired loan amount and you will fees title

- Cause you prefer the amount of money

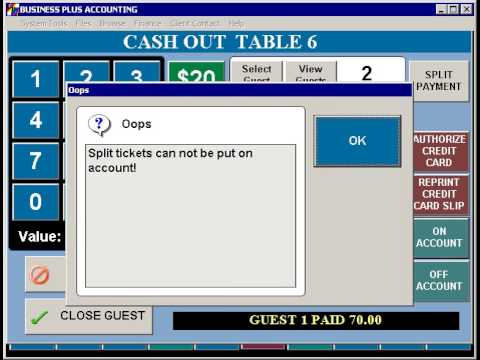

When you have registered the required information, extremely loan providers manage a smooth credit assessment, without any affect your credit rating. You will want to establish the sort of credit assessment lenders can do prior to proceeding.

Levon L. Galstyan, a certified public accountant having Pine Take a look at Rules Group inside Auburn, Ca, said: Understand whether or not loan providers pull your credit score hard or flaccid whenever as long as you a bid even though you research rates to own an excellent the financing. Score prices away from loan providers just who show you your own cost only using a delicate eliminate since the a hard borrowing from the bank eliminate tend to reduce your get, at the least temporarily.

What will happen once i pre-qualify for a consumer loan?

Once you pre-qualify for a personal bank loan, the lending company brings information regarding also offers, including the loan amount, price and you will name you might discovered. Very carefully review the latest also provides, and look in the event that discover one associated feespare your own promote with most other pre-degree also offers you received, and pick usually the one that’s best for you.

Once you have chosen a personal bank loan, you can undertake the deal and offer the lender with every other necessary paperwork, such as evidence of earnings (elizabeth.g., spend stubs, taxation statements). Once final recognition, you are able to indication the mortgage documents and possess usage of your loan funds.

Faq’s (FAQ)

loans for credit score 400 to 450

Pre-qualifying means a primary overview of on your own-advertised guidance demonstrates to you meet with the lender’s earliest loan criteria. In comparison, to locate recognized for a loan, your own lender have to thoroughly remark your own creditworthiness, which often includes performing an arduous credit check and you will verifying facts of income.

Most pre-certificates are merely best for 29 to 3 months. The offer throughout the bank will identify how much time the fresh new pre-degree continues. Even if the pre-qualification is still valid, you should prove if you however pre-qualify when the there are changes into the borrowing from the bank otherwise earnings.

Your financial will give you an over-all idea of the rate you can buy when you pre-be eligible for that loan. It won’t finalize the real price and you may total conditions you’re going to get until you is formally approved with the financing.

Bottom line

Delivering pre-entitled to an unsecured loan can be brief and you will simple. To get going, you provide the financial which have very first information about yourself, such what kind of cash we want to use, your revenue plus estimated credit rating. The financial institution product reviews this short article and you can does a flaccid credit check to find out if you pre-meet the requirements. This won’t impact your credit rating.

If you pre-qualify for the borrowed funds, the lending company often express the new costs and you may terms and conditions you could receivepare these with other lenders’ proposes to get the best choice for you. Once you discover consumer loan you prefer, you’ll formally apply online, give the bank having any requisite data files, discover mortgage selection you desire, become approved and have the loans need.