The newest availability goal enjoys stayed a core worthy of, although student education loans are extremely the new centerpiece of one’s aid build

The new federal pupil help program was created to provide improved availability to higher knowledge among People in america if not less inclined to enter.

Up until 2012, Backed Stafford Money was indeed available to scholar and you may elite group college students whom presented enough economic you want. The eye in these finance is paid back from the U.S. Department from Education due to the fact student are enrolled in college at minimum 1 / 2 of-date, during the a half dozen-few days sophistication several months adopting the separation of university, and you can through the attacks of deferment. For the 2011-a dozen honor 12 months, graduate students was basically permitted borrow to $20,five hundred regarding the Stafford Loan system from year to year; of these eligible, the initial $8,five-hundred would-be deemed a Backed Stafford loan. step one

Having graduate and you can professional college students, the fresh new Budget Handle Act away from 2011 eliminated the new when you look at the-college focus subsidy on the the brand new Stafford funds originated on the or after . Scholar people might still acquire around $20,five-hundred annually inside Unsubsidized Stafford Finance, having an aggregate Stafford Financing restriction out of $138,500. 2

grams., Sponsored Stafford, Unsubsidized Stafford, PLUS) into the relevant ten-season Treasury notice price. The speed to possess graduate Unsubsidized Stafford Funds paid between is actually 5.twenty eight % (this new ten-12 months Treasury mention price also 3.6%, the latest fixed fee because of it loan kind of).

Due to the fact 2013, rates of interest with the federal college loans was in fact set per year of the adding a predetermined fee you to definitely varies from the mortgage sort of (elizabeth

This new dining table less than suggests the other dominant balance up on cost to possess a regular legislation pupil (we.e., individual who borrows about $8,five-hundred in the Stafford Financing program each year for three decades) as a result of the loss of the fresh new in-college or university notice subsidy. Because table can make obvious, perhaps the lowest interest rate environment may cause legislation pupil loans to improve inside significant means s.

More over, the added dominant explained more than could well be susceptible to constant attract costs regarding payment months, further improving the overall cost of your own personal debt. Eg, at the a great six per cent interest more an excellent ten-season cost period, a debtor you will definitely shell out a lot more need for excess of $step one,200; in the event the a debtor spread repayments more than 2 decades (frequent among law pupil borrowers), the excess attract you will boost beyond $dos,500.

Law graduates are among the really in debt subgroup out-of education loan borrowers; but this problem influences all scholar and you can professional students with presented economic you desire. Higher can cost you may have a disappointing affect which populace, given their pricing-sensitiveness. Highest can cost you also can exacerbate the newest downsides economically eager students will face immediately following graduation. A job consequences tend to be reduced favorable of these students than just other people, hampering their capability to cope with its student loan financial obligation and create money long-identity.

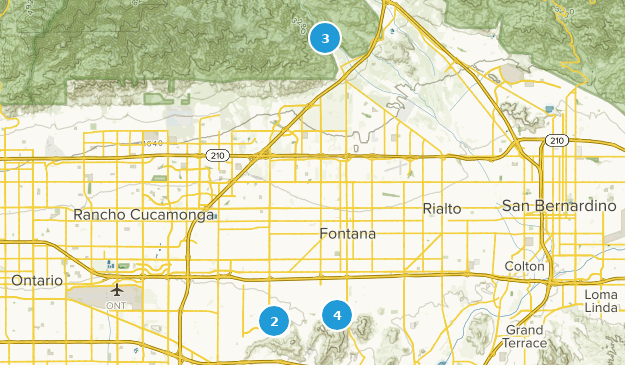

In addition to loss of paid finance getting graduate students has been acknowledged by people in Congress once the a disincentive for people installment loans in Hudson PA with bad credit in order to keep their education. Representative Judy Chu (D-CA-27) has introduced the latest Protecting All of our Pupils by the Terminating Scholar Prices you to definitely Enhance Financial obligation (Post Grad) Work 5 as a result compared to that situation. The new Post Graduate Act do repair parity for student and you can scholar training of the reinstating graduate students’ qualifications getting government sponsored student education loans.

In the a culture where state-of-the-art level are needed in the a massive and you will growing quantity of industries, repair of your into the-school attract subsidy would help increase the fresh new cost away from, and you can usage of, graduate and you can elite group training, if you’re providing the latest seeks of your own federal services system and you will benefitting neighborhood along the way.

About AccessLex Institute: AccessLex InstituteSM, in partnership with their almost 2 hundred nonprofit and you can state-associated ABA-recognized Member rules colleges, could have been dedicated to boosting accessibility judge training and maximizing the latest value and value regarding a rules education given that 1983. The brand new AccessLex Heart to have Courtroom Training ExcellenceSM advocates to own regulations you to definitely create judge training are better for students and you may society the same, and you will performs look into key issues up against court degree today. New AccessLex Heart for Knowledge and you can Monetary CapabilitySM offers to the-university and online monetary training coding and you may info to assist youngsters with confidence would its profit on their cure for gaining individual and you can elite group success. AccessLex Institute is an effective nonprofit providers that have place of work inside the Western Chester, Pennsylvania, and you will Washington, D.C. and you will occupation workplaces in the U.S.

1 You.S. Service out-of Knowledge, Federal Scholar Support, Pupil Feel Category, The Federal Figuratively speaking: Learn the Basics and you can Control your Personal debt, Washington, D.C., 2010.

2 Just about $65,five hundred associated with amount tends to be from inside the paid finance. The fresh new scholar aggregate limitation comes with the Stafford fund obtained for undergraduate analysis.

step three $25,500 means the $8,five-hundred from year to year to have three-years you to a rules scholar is previously permitted use when you look at the Subsidized Stafford Loans.